Difference between revisions of "SD2 Economize"

Sean.Logan (talk | contribs) (→ECONOMIZEv.3) |

Sean.Logan (talk | contribs) |

||

| Line 9: | Line 9: | ||

== Features == | == Features == | ||

| − | + | <ul> | |

| − | + | <li>News articles are generated based on events to contextualize changes and help the player evaluate what choices they should make. Every once in a while a text news story will appear and it will address recent changes in the stock market. You should make your choices to invest in one company or move out of another. </li> | |

| − | + | <li>Economic Crisis can occur. Minimize your losses by diversifying. Putting all your eggs in one basket is gambling, but diversifying is investment.</li> | |

| − | + | <li>Some stocks have dividends, money that can be reinvested in the company for more shares or used elsewhere.</li> | |

| − | + | <li>Pretend DJIA is the main list for traded stocks (keeps it simple). 15-30 stocks to keep track of.</li> | |

| − | + | <li>Turn based – day by day stock management, but can skip ahead if too tedious. Skips will be interrupted if an event occurs. Play at your own pace and learn how the market moves.</li> | |

| + | </ul> | ||

== Motivation == | == Motivation == | ||

| − | + | Make pretend money! But being good at a simulation doesn't mean that you are a good investor. It's at least a lesson on how unpredictable it can be. | |

== Genre == | == Genre == | ||

| − | + | Turn based strategy... sort of. | |

== Target customer == | == Target customer == | ||

| − | + | Aspiring investors, those that lost all their money, and the idly curious. | |

== Design goal == | == Design goal == | ||

| − | + | Simple, casual, informative and interesting. | |

== The Formula == | == The Formula == | ||

| Line 52: | Line 53: | ||

== Example situations == | == Example situations == | ||

| + | <ul> | ||

| + | <li> Rapper NAS takes legal action against the NASDAQ for using his likeness without permission. The suit is currently in litigation. | ||

| + | (Can decrease ALL values the first week while the court proceeding, and then either further decrease values when NASDAQ loses; or increase all values when the win) </li> | ||

| − | + | <li>A socialite that's daughter of the head of one of your Hotel stocks is caught in a scandal. | |

| − | ( | + | (Value lowers because the hotel must be bad if she went to another hotel)</li> |

| − | + | <li>A flailing bank get bought up by another. Parts of the market fall as their accounts are switched | |

| − | ( | + | (- 3 points for Gas, Grocery and Entertainment stocks)</li> |

| − | + | <li>A company stops negotiating with another company to merge. The merger was highly publicized and was hostile when it began | |

| − | ( | + | (1 of players stock randomly drops by 10)</li> |

| − | + | <li>A high ranking employee leaves one of your stocks suddenly without warning. Negotiations were happening behind your back when their contract was up | |

| − | + | (1 stock randomly drops by 5)</li> | |

| − | |||

| − | |||

| − | (1 stock randomly drops by 5)< | ||

| − | |||

| − | |||

| − | |||

| + | <li>A founder of one of the companiesyou invest in has a heart attack. Is very serious and puts him in the hospital. Also happens after a news paper mistakenly published an obituary of his death. | ||

| + | (Company stock goes down)</li> | ||

| + | </ul> | ||

== Growth modifiers == | == Growth modifiers == | ||

| + | <ul> | ||

| + | <li>Positive/Negative growth shown via Consumer Price Index (CPI)</li> | ||

| − | + | <li>CPI is powered via random numbers. This represents the “Virtual Market” of the overall economy</li> | |

| − | |||

| − | |||

| − | |||

| − | |||

| − | + | <li>CPI changes accordingly to the random numbers</li> | |

| − | + | <li>All companies have different +/- growth modifiers</li> | |

| − | - | + | <li>Events triggered when +/- growth of companies hits a certain point</li> |

| − | + | <li>Events modify growth modifiers universally</li> | |

| − | - | + | <li>Once event modifiers are present/triggered they have the potential to influence +/- growth changes in companies or the CPI</li> |

| − | + | <li>Events simply modify the CPI overall for one two large steps. Companies (usually) will have they’re formulas not change as a result of the trigger/event.</li> | |

| + | <li>Each year in the simulation is started off with estimated projections for the growth of the company over the year.</li> | ||

| + | </ul> | ||

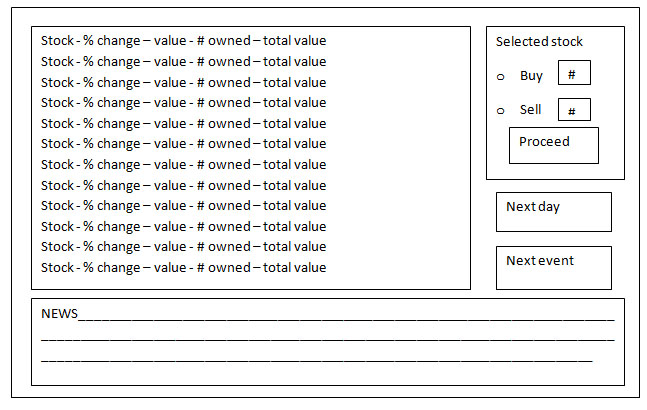

== Example of game screen == | == Example of game screen == | ||

Revision as of 17:52, 15 October 2008

Contents

ECONOMIZE

by Tim Heverin, Nathaniel Goddard, Sean Logan, Akil Henry

High Concept

Navigate the risks and benefits of Wall Street. Try and survive economic downfall with smart trading. A stock game that doesn't require a whole lot of math

Features

- News articles are generated based on events to contextualize changes and help the player evaluate what choices they should make. Every once in a while a text news story will appear and it will address recent changes in the stock market. You should make your choices to invest in one company or move out of another.

- Economic Crisis can occur. Minimize your losses by diversifying. Putting all your eggs in one basket is gambling, but diversifying is investment.

- Some stocks have dividends, money that can be reinvested in the company for more shares or used elsewhere.

- Pretend DJIA is the main list for traded stocks (keeps it simple). 15-30 stocks to keep track of.

- Turn based – day by day stock management, but can skip ahead if too tedious. Skips will be interrupted if an event occurs. Play at your own pace and learn how the market moves.

Motivation

Make pretend money! But being good at a simulation doesn't mean that you are a good investor. It's at least a lesson on how unpredictable it can be.

Genre

Turn based strategy... sort of.

Target customer

Aspiring investors, those that lost all their money, and the idly curious.

Design goal

Simple, casual, informative and interesting.

The Formula

Each stock has a set growth per year, broken down to have growth over the course of the year with events in the simulation causing the overall number to diverge. The stock is assigned a base growth stat from anywhere to 2% to 15% in a year depending on what industry or projected growth.

The explicit numbers and values are still being worked out.

Current stock value = a preassigned number at the beginning of the game. This is the most fluid value.

Base growth per year = a preassigned number that, if no other factors were involved, the stock would grow in value with.

Modifiers = given in example in the following sections. They are either cultural events, or corporate events that occur with regularity, but with unpredictable effect.

(Current stock value)*(Base growth per year) = projected value of stock

(Current stock value)*((Base growth per year)+/-(Modifiers) = New current value

Example situations

- Rapper NAS takes legal action against the NASDAQ for using his likeness without permission. The suit is currently in litigation. (Can decrease ALL values the first week while the court proceeding, and then either further decrease values when NASDAQ loses; or increase all values when the win)

- A socialite that's daughter of the head of one of your Hotel stocks is caught in a scandal. (Value lowers because the hotel must be bad if she went to another hotel)

- A flailing bank get bought up by another. Parts of the market fall as their accounts are switched (- 3 points for Gas, Grocery and Entertainment stocks)

- A company stops negotiating with another company to merge. The merger was highly publicized and was hostile when it began (1 of players stock randomly drops by 10)

- A high ranking employee leaves one of your stocks suddenly without warning. Negotiations were happening behind your back when their contract was up (1 stock randomly drops by 5)

- A founder of one of the companiesyou invest in has a heart attack. Is very serious and puts him in the hospital. Also happens after a news paper mistakenly published an obituary of his death. (Company stock goes down)

Growth modifiers

- Positive/Negative growth shown via Consumer Price Index (CPI)

- CPI is powered via random numbers. This represents the “Virtual Market” of the overall economy

- CPI changes accordingly to the random numbers

- All companies have different +/- growth modifiers

- Events triggered when +/- growth of companies hits a certain point

- Events modify growth modifiers universally

- Once event modifiers are present/triggered they have the potential to influence +/- growth changes in companies or the CPI

- Events simply modify the CPI overall for one two large steps. Companies (usually) will have they’re formulas not change as a result of the trigger/event.

- Each year in the simulation is started off with estimated projections for the growth of the company over the year.

Example of game screen

You click on the stock you would want to buy or sell. On the selected stock portion of the window, you can click to perform either action and insert however many you would like to move. The stocks that are affected by the news flash to let the player know what is going on.